🔑 It’s Not About How Much You Earn — It’s About What You Do With It

When we hear that someone earns ₹70,000 a month, we assume they must be doing well financially. And when we hear someone earns only ₹30,000, we might think they’re struggling.

But the reality is often very different.

In the world of personal finance, what truly matters isn’t just income — it’s how you manage that income. A person with a modest salary but disciplined habits can actually become wealthier than someone earning more but spending carelessly.

👥 Two People, Two Mindsets

Let’s take an example of two individuals.

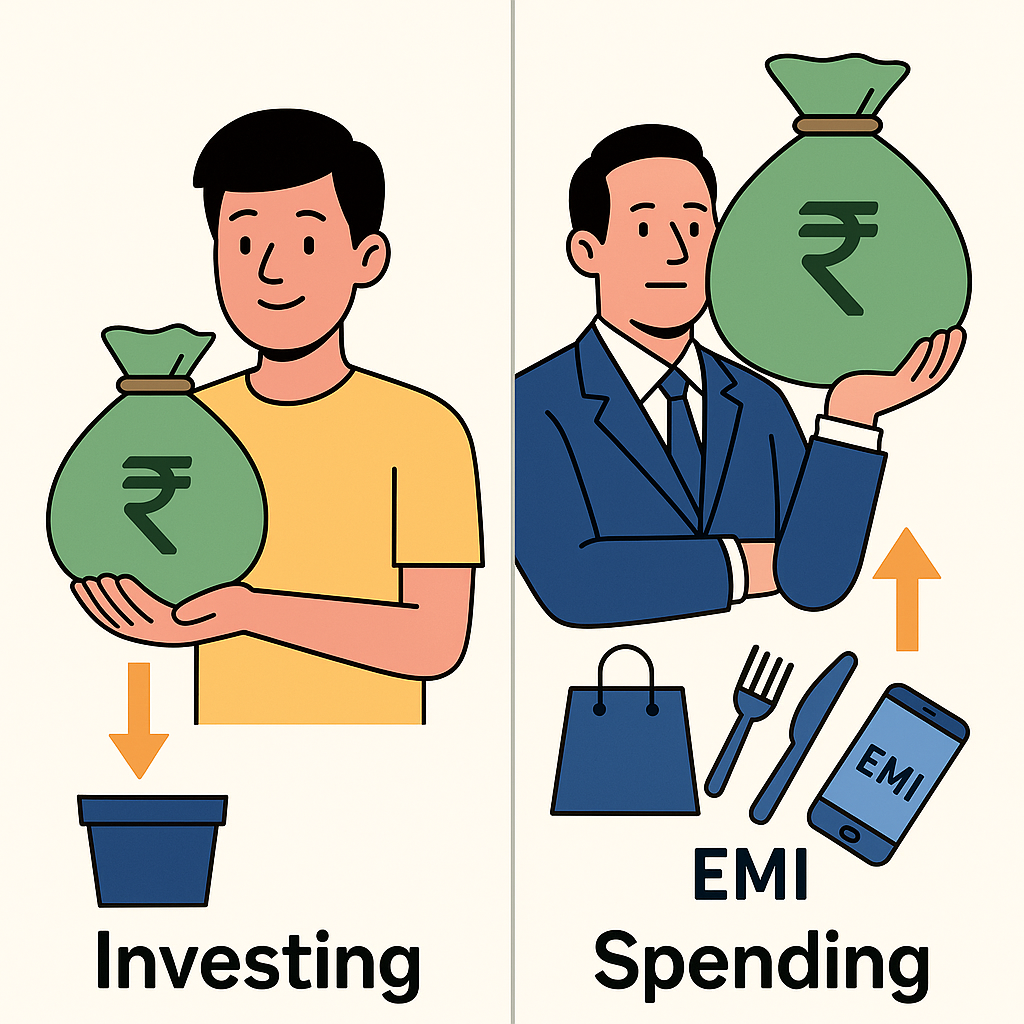

🧑 Person A: The Modest Investor

- Salary: ₹30,000 per month

- Lives simply, avoids unnecessary expenses

- No EMIs or loans

- Systematically invests ₹10,000 every month

- Tracks expenses and sticks to a budget

👨 Person B: The High-Earner Spender

- Salary: ₹70,000 per month

- Lives a “rich” lifestyle — latest gadgets, dining out, expensive clothes

- Has EMIs for phone, car, and credit card

- Saves little and invests just ₹2,000 per month

On the surface, Person B seems more successful. But fast forward 15 or 20 years, and the story changes completely.

📈 The Long-Term Impact of Investing vs Spending

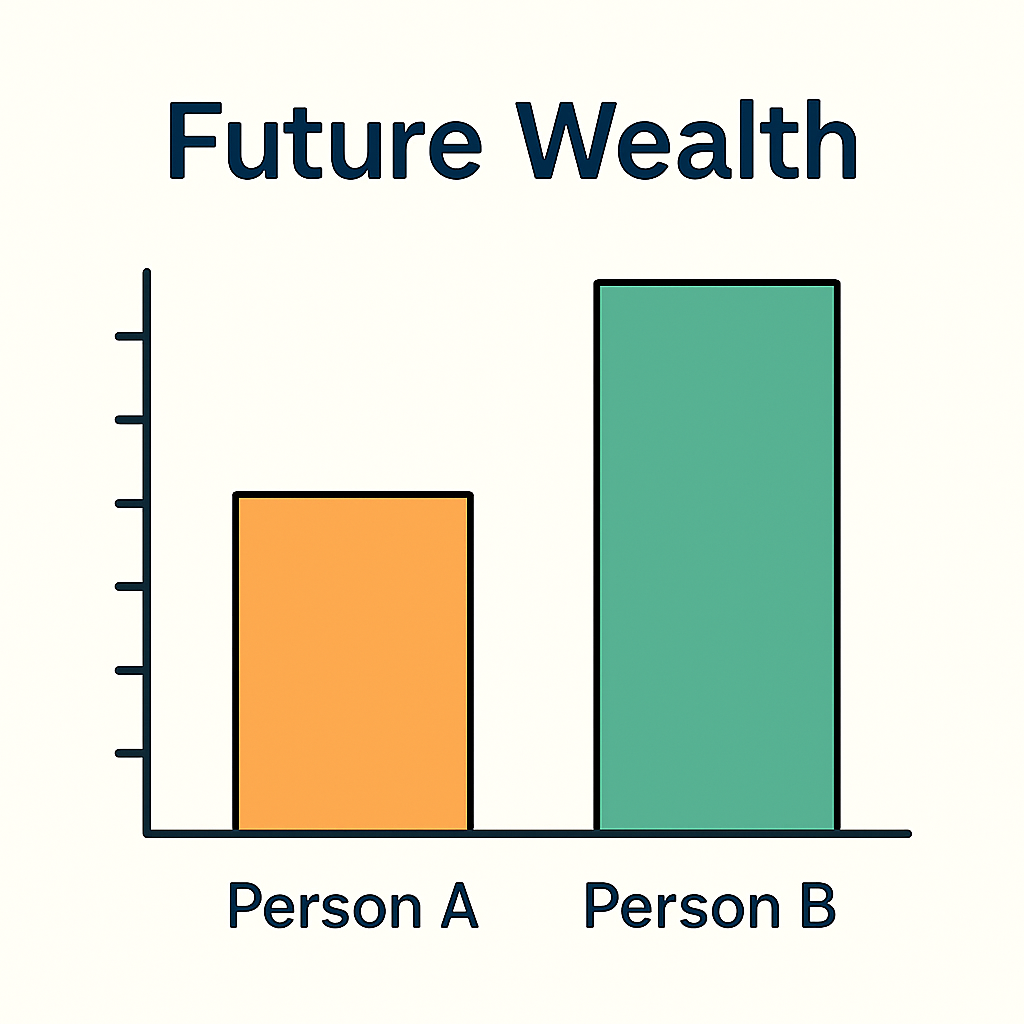

Let’s say both continue their current habits for 20 years, and both invest in mutual funds with a 12% average return.

- Person A investing ₹10,000/month → Grows to about ₹1 crore

- Person B investing ₹2,000/month → Grows to only ₹20 lakhs

Despite earning more than double, Person B ends up with five times less wealth.

🧠 What Made the Difference?

1. Savings Rate Matters More Than Salary

Person A invested a third of their salary. Person B barely invested at all. The amount you save and invest consistently makes a much bigger difference than how much you earn.

2. Avoiding EMIs = Financial Freedom

Living on EMIs creates an illusion of wealth. You own things, but you’re still paying for them. Person A avoided this trap and focused on growing real assets.

3. Compounding Rewards the Patient

Money invested early grows faster due to compounding. The longer it stays invested, the more powerful it becomes. It’s not magic — it’s math.

4. Simple Living Brings Peace

Instead of impressing others with gadgets or cars, Person A chose peace of mind. No debt. No stress. Just steady progress.

🔁 A Shift in Mindset: From Spending to Growing

Most people work hard just to earn more and spend more. But the key to real wealth is in earning enough, spending wisely, and investing the rest.

You don’t need to be rich to start investing. You become rich because you started investing early and consistently.

✅ Final Thoughts: Choose Wealth, Not Appearances

If you’re earning a modest salary today, don’t feel discouraged. You have the power to build real wealth — not overnight, but steadily. By saving more, avoiding unnecessary loans, and making investing a monthly habit, you can outpace even those who earn more than you.

💬 Remember: It’s not about living a rich life — it’s about building a life where money works for you, not the other way around.